I recently read a book called “The Energy Bus” and it really reminded me of why I love what I do. I found myself wanting to be the character Joy. Sometimes gently, sometimes not-so-gently guiding people in the right direction. First, I highly recommend reading the book. It’s a quick, easy read, but life-changing.

It also reminded me of the number 1 rule that I strive to impress upon my clients, but I didn’t realize this was a “rule” before I read the book. That’s possibly because I’m not a big fan of rules in general, but that’s another article by itself.

You are the driver of your bus. So many people come to our office to talk about their debt and credit issues feeling dejected, hopeless, and out of options. My goal for every single person that comes in like that is to leave energized, hopeful, and full of options. But, it starts with you being able to see the light at the end of the tunnel. That’s our job. To give you a path to find the light and then energize you to keep working towards it.

Now, I can’t say it just like that. When was the last time your attorney said, “Come on in to our office, we’re going to talk about positive mindset to get everyone on board your energy bus!”? I’d get locked up in a looney bin. But, I can practice what I preach and significantly impact the lives of my clients, just like Joy did.

Being the driver of your bus means taking control and steering your life the way you want it to go. That’s easier said than done, but it also can start with one small change. Don’t be afraid to find out what your options are. We talk to so many people who put off taking control so long that it’s negatively impacted their health, their relationships, their work, etc. What if you knew that taking control and finding out that there are options would result in better health, relationships, work, etc.? Would you be less fearful? You are the driver of your bus!

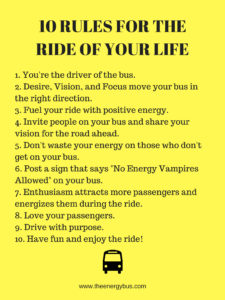

Here is a list of the rest of the rules. Some I like more than others. I definitely agree with getting rid of energy vampires in your life. Life is too short to hang around people who literally suck the life out of you! If you come into our San Ramon office, this will likely be hanging on the wall.

The full book title is The Energy Bus: 10 Rules to Fuel Your Life, Work, and Team with Positive Energy by Jon Gordon. It’s available on Amazon: https://amzn.to/2CcSfmy

On a final note, there is also a children’s version. Your kids are watching how you react to challenges and difficulties all the time and they will copy you. The best gift you can give your children is to teach them that they are the driver of their own bus. https://amzn.to/2PponFv

This is just a basic overview and is not legal advice specific to your situation. If you have questions about your rights when it comes to debt and credit, you should speak with an attorney in your area for legal advice. If you live in California or North Dakota and would like to speak with Jen Lee Law regarding your situation, please schedule an appointment on our scheduling site.