138% Interest?!

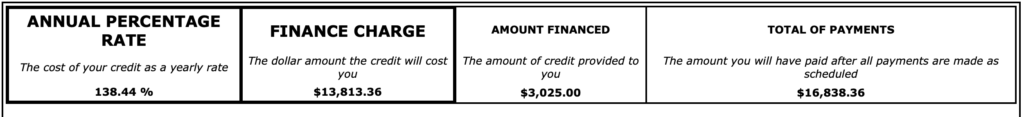

Once again, this week’s blog post is related to things we are seeing in the news and with clients. In the news, Bloomberg published an article this morning titled, “America’s Middle Class is Addicted to a New Kind of Credit.” In our office, we saw a disclosure on a loan agreement that consisted of 138.44% interest that the borrower would pay on a loan, which is crazy. Let’s break it down and figure out why this is a bad deal for the borrower.

The borrower needs $3,025 and went to an online lender to try to borrow the money. The lender quoted a 138.44% interest which included the $3,025 that the borrower needed, PLUS $13,813.36 in interest. That means that the borrower is going to have to pay $16,838.36 over 4 years (48 months). Now, most people’s eyes glaze over when we start talking about numbers, but we hope you can see that this is NOT a good deal for the borrower.

So, how do you avoid these types of loans and debts? Sometimes, easier said than done, but here are a few ideas:

- Create a budget or spending plan to help understand where your money is going. Look at your last 6 months of bank statements and credit card statements to figure out if you have any expenses you can cut to help with building a cushion.

- Have an emergency fund that you don’t touch unless it’s actually an emergency. Anything requiring you to borrow $1,000 at 138% interest had better be an emergency and having a small amount set aside for those kinds of situations can help stabilize your budget.

- Evaluate your options. If you are at the point where you are borrowing money at 138% interest, there is likely a bigger issue with your credit and/or finances. That’s ok and it is much better to get a handle on the issue before taking on more debt than after possibly making a mistake.

If you are considering one of these loans, please do anything you can to avoid signing on the dotted line. Also, please remember that you are not alone when it comes to dealing with debt and credit issues. It’s more common than you realize.

This is just a basic overview and is not legal advice specific to your situation. If you have questions about your rights when it comes to debt and credit, you should speak with an attorney in your area for legal advice. If you live in California or North Dakota and would like to speak with Jen Lee Law regarding your situation, please schedule an appointment.