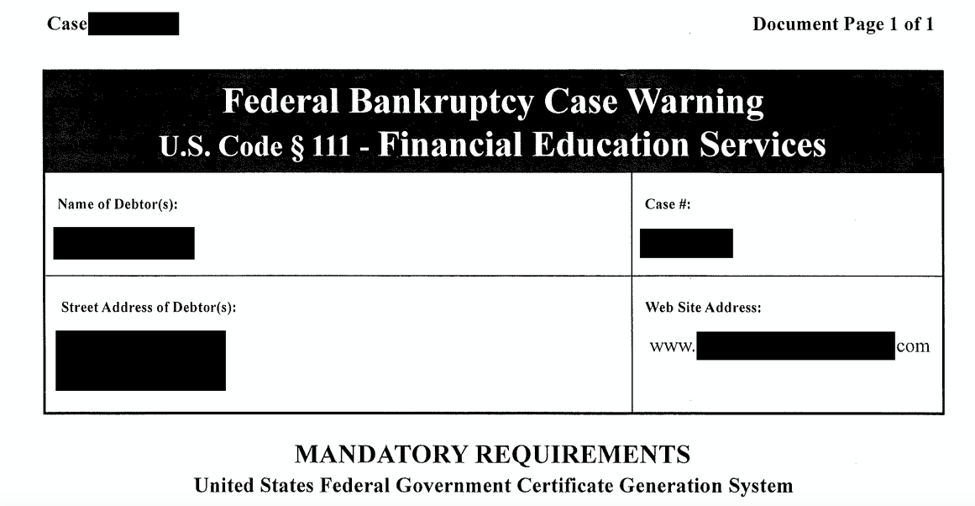

It is increasingly difficult to stay on top of all of the scams out there when it comes to debt, credit, and financial issues. However, this one really struck a nerve recently when a client received this notice after filing for bankruptcy:

This looks pretty official, right? If you got this in the mail after filing your bankruptcy, you would probably be concerned that there is something wrong with your case, after all it says “Warning” at the top. This is NOT an official court document. This is an advertisement. Nowhere on the form does it tell you that it’s an advertisement. And, the code section at the top really has nothing to do with the actual requirement of taking the course.

When you file for bankruptcy, you are required to take a credit counseling course before filing and a financial management (or debtor education) course after filing. If you file with our firm, we send you different options for the courses at the proper times because timing is important. However, once you file for bankruptcy, there are companies that will bombard your email and mailbox with offers for the financial management course. This is one of those offers.

The reason I hate these advertisements is because our clients are stressed enough with filing bankruptcy. They don’t need extra stress in the form of an unofficial document that makes it look like something is wrong with their case. Now, we get to send a warning to all clients to try and ease the stress before they get something like this in the mail.

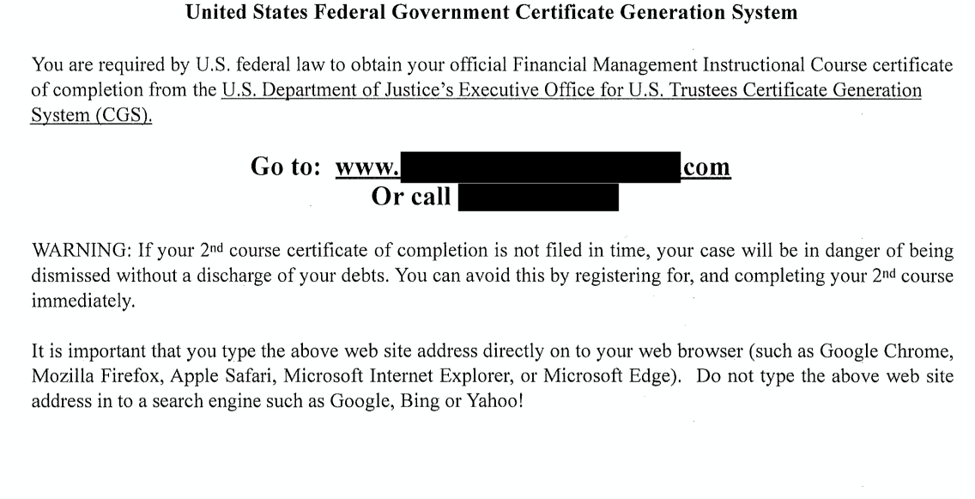

Here’s what the bottom of this letter looks like (with the name of the agency redacted):

This language makes it sound like the government requires you to obtain the certificate from this particular agency, which is absolutely not true. There are many accredited providers out there who offer this course.

Also, the icing on the cake, is that it tells you not to research the company by typing the company name into a search engine. If you do type it in, you get a bunch of alternatives to this company and they don’t want you to know that there are other options.

So, please check with your lawyer when you receive things like this and please don’t panic. Our goal is to reduce stress in your life, not create it!

This is just a basic overview and is not legal advice specific to your situation. If you have questions about your rights when it comes to debt and credit, you should speak with an attorney in your area for legal advice. If you live in California or North Dakota and would like to speak with Jen Lee Law regarding your situation, please schedule an appointment.