Living on credit is a day-to-day reality for millions of Americans.

Consumer debt in the United States totals $14.1 trillion — that’s $14,100,000, 000,000 – with the average person owing over $90,000 (according to Experian’s 2019 Consumer Debt Study). This includes credit cards, consumer loans, secured loans on personal property (electronics, furniture, jewelry, etc.), car loans, mortgages, and student loans. Given that many people are living paycheck-to-paycheck and the job insecurity caused by the global pandemic, it may be reasonable to consult an attorney about financial stress and debt management options. This may be the case even if you have a six figure income and have never missed a payment; it is better to consult an attorney early (and know your options) than to wait until your back is against the wall.

But when is that point? Factors to consider, regardless of income, are –

- Are you making minimum monthly payments?

- Are most of your debts credits cards with high interest rates?

- How much do you owe in relation to your monthly income?

- Are you behind on your mortgage or rent?

- Do you have debts in collection?

- Do you have money left over to save for retirement?

- Are you on installment plans for medical bills or tax debt?

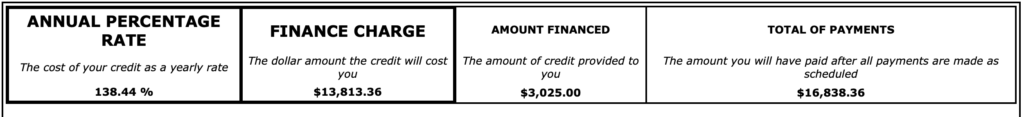

You might improve your situation through stricter budgeting, debt consolidation, or negotiating settlements with your creditors. This is not always feasible depending on the size of the debts, the interest rates, and income. If you are making the minimum monthly payments on high interest credit cards with large balances and are not saving for retirement, bankruptcy might be your best option. For non-business debts, there are two types of bankruptcy, Chapter 7 liquidation and Chapter 13 reorganization. The main difference is whether you are trying to protect assets (e.g., house, car, etc.) from creditor repossession/foreclosure or you just want to get rid of your debts and get a “fresh start.” Your credit score is likely to increase after a bankruptcy because you are less of a risk to potential lenders. You can also qualify for a mortgage within 12 months of a bankruptcy. An experienced attorney can evaluate your situation and tailor a strategy to meet your needs.

This is just a basic overview and is not legal advice specific to your situation. If you have questions about your rights when it comes to debt and credit, you should speak with an attorney in your area for legal advice. If you live in California or North Dakota and would like to speak with Jen Lee Law regarding your situation, please schedule an appointment.